According to CCM research, China’s price of methomyl TC in March 2016 still remains at a low

level. Even though the busy season of 2016 to use insecticides is coming day by

day, there haven’t been any favorable factors seen to revitalize the depressed

market. It is estimated that the methomyl market is not going well in later

period.

According

to analyst CCM, China’s price of methomyl technical in March 2016 is still

stuck at a low level. Experienced industry insiders disclosed that the high

stocking and the weak demand are now the two major blocks keeping the price of

methomyl down. Although the busy season of 2016 to use insecticides is

approaching, none of favorable factors have showed yet to boost the gloomy

market. Facing the technical market with high inventory and the stagnant sales

at home and abroad, there is possibility and space for China’s methomyl TC

price to go down. Therefore, the methomyl market in later period is not

promising.

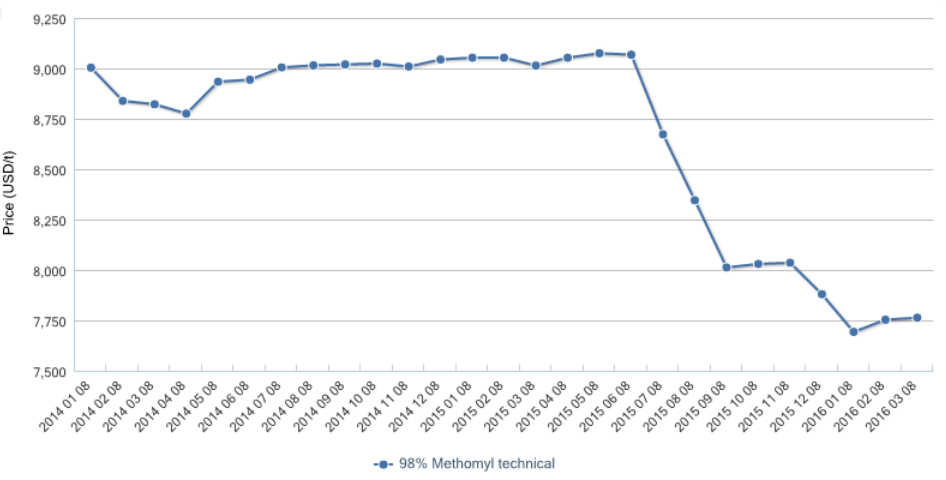

Traditionally, the insecticide market would usher into its busy season in

March. The depressed market throughout winter would gradually recover in

spring and the prices of pesticide products, lingering at a low level, would

meet different degrees of increases. However, in the recent two

years, the price of methomyl TC has developed abnormally and even declined

steadily instead of rising significantly in the busy season. It is the high

stocking and the weak demand that keep the price from growing. And it is the

overcapacity and the limited and slow consumption in the downstream sector that

should be responsible for the problem of high inventory.

Ex-works price of 98% methomyl TC in China,

Jan. 2014-March 2016

Source: CCM

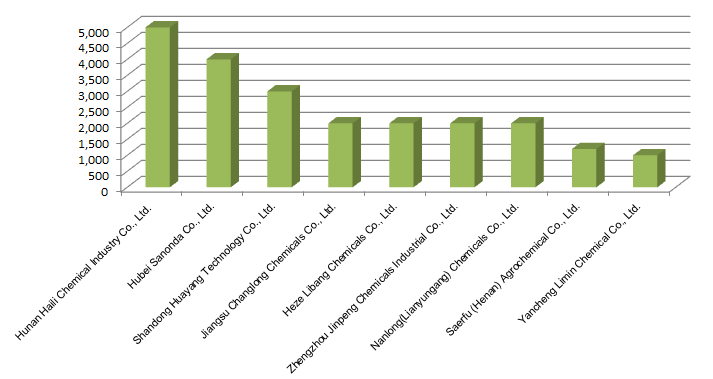

It

is learned from the data released by China Crop Protection Industry Association

(CCPIA) that now the production capacity of major domestic methomyl producers'

devices totals around 20,000 t/a. Some enterprises are equipped with big

production capacity. They are Hunan Haili Chemical Industry Co., Ltd. (Hunan

Haili - 5,000 t/a), Hubei Sanonda Co., Ltd. (Hubei Sanonda - 4,000 t/a),

Shandong Huayang Technology Co., Ltd. (Shandong Huayang - 3,000 t/a), Jiangsu

Changlong Chemicals Co., Ltd. (Jiangsu Changlong - 2,000 t/a) and Nanlong

(Lianyungang) Chemicals Co., Ltd. (Nanlong Chemicals - 2,000 t/a). Actually,

the annual outputs of these enterprises have greatly exceeded the actual

downstream demand.

According to market surveys, now Hunan Haili, Nanlong Chemicals, Shandong

Huayang, Jiangsu Changlong are generally bearing the inventory pressure.

Shandong Huayang said that it stopped and overhauled the devices of producing

methomyl TC, consumed the stocks, and could take new orders as usual.

Shandong Libang Chemical Co., Ltd. also said it suspended production of

methomyl TC for overhaul, consumed the stocks, and could take new orders as

usual.

Jiangsu Jialong Chemical Co., Ltd. said it suspended production of methomyl TC

for overhaul. As the company has no inventory now, it will not quote for the

moment.

Hunan Haili said that its devices run smoothly, and the company has inventory

and can take new orders.

Nanlong Chemicals also said that its devices run regularly, and the company has

inventory and can take orders as usual.

Kaifeng Luyu Biotechnology Co., Ltd. said that it suspended production of

methomyl TC for overhaul. As the company has no inventory for the moment and it

cannot quote.

Production capacities

of some major producers for methomyl TC in China, 2015

Source:

CCPIA

In

regard to the downstream consumption market, methomyl, a kind of broad-spectrum

carbamate insecticide, is of great volatility and high inhalation toxicity. In

fact, the Chinese government has banned methomyl from applying on tea trees,

fruit trees and vegetables since June 2011. Now domestic methomyl products are

mainly used for controlling the pests in cotton and other commercial crops and

in forest trees. Besides, affected by the gloomy economic environment all over

the world and developed countries' restriction to methomyl, the export volume

of methomyl in recent years also recorded a significant decline. According to

China Customs and CCM, China's export volume of methomyl was 8,592.01 tonnes in

2015, substantially down by 27.10% from 2014.

About CCM:

CCM is the leading

market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients

include Monsanto, DuPont, Shell, Bayer, and Syngenta.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.

Tag: methomyl, fungicide